In their latest research, property experts, Open Property Group, have shed light on the shifting trends of UK homeowners, particularly focusing on their inclination to move house and the preferred destinations, with Wales and the West Country witnessing a surge in interest.

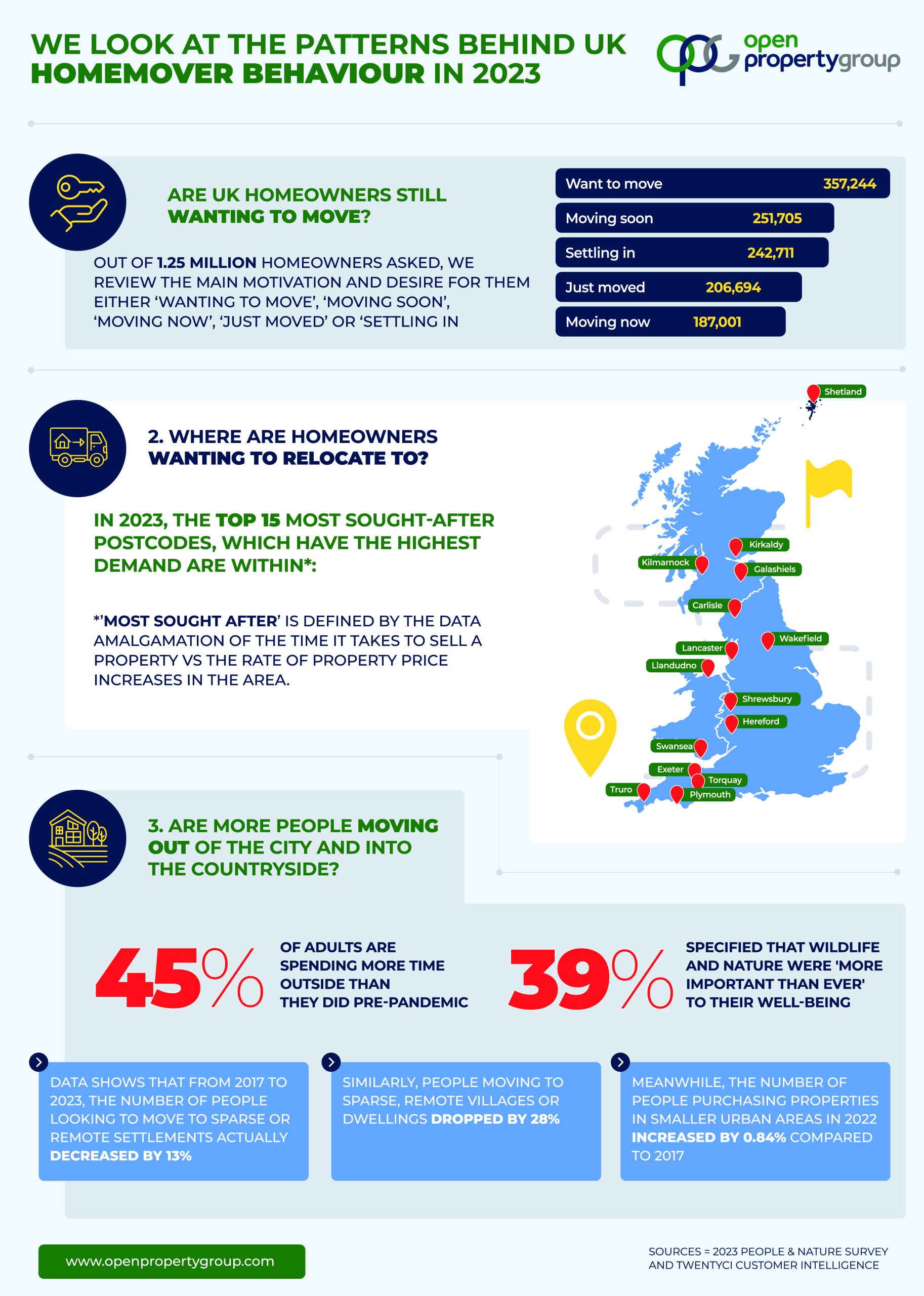

The study, which surveyed 1.25 million homeowners, revealed that an impressive 39% of respondents are considering a move to rural areas, attributing the allure of wildlife and nature as “more important than ever” in their relocation decisions.

Interestingly, since the pandemic outbreak, 49% of adults have found themselves spending more time outdoors than they did prior to the arrival of COVID-19.

Delving further into the survey data:

- 357,244 homeowners expressed their desire to move

- 251,705 homeowners stated they are planning to move soon

- 242,711 homeowners are settling into new homes

- 206,694 homeowners have recently completed their move

- 187,001 homeowners are actively in the process of moving

Despite these notable figures, recent data highlights a 28% decline in people moving to sparsely populated or remote villages. Additionally, over the years from 2017 to 2023, the number of homeowners seeking to relocate to remote or sparse settlements has decreased by 13%.

Jason Harris-Cohen, Managing Director of Open Property Group, shared insights into the ongoing transformation in the UK’s property market, pointing out the surge in popularity for regions in the West of the country. Factors such as better value for money compared to London, the South East, and major cities are driving this shift, coupled with the need for affordability amidst a cost of living crisis.

The current economic climate, with its implications on inflation, the Bank of England base rate, and mortgage rates, has put pressure on buyers’ budgets. Nevertheless, the desire to move remains strong, leading individuals to consider alternate locations and property types.

Semi-rural and rural areas continue to offer more cost-effective options than urban and inner-city regions. This trend is expected to persist in the coming months as people return to office work, potentially prompting relocations to reduce commuting times. Such factors are likely to cause metropolitan house prices to rebound.

Although the data indicates a decline in the trend for rural living over the past six years, there may be a surge as prospective buyers pursue attractively priced properties. Moreover, there is anticipation that borrowers may opt for longer mortgage terms, such as 30 years or interest-only mortgages, to mitigate the impact of higher repayment rates.

Jason also acknowledges a substantial segment of homeowners, approximately 357,244, who are currently biding their time, waiting for mortgage rates to fall and house prices to drop before progressing with their moving plans. In the interim, they may choose to invest in property improvements, enhancing their current living environment while simultaneously adding value to their homes. Such delayed movers might potentially fuel a property peak in late 2024 or early 2025.