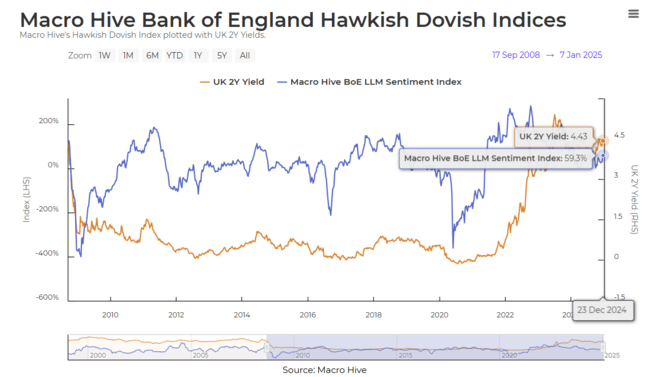

Macro Hive, a pioneer in AI-powered financial analytics, has announced the expansion of its central bank sentiment indices to include the European Central Bank (ECB), the Bank of England (BoE), and the Bank of Japan (BoJ).

These advanced tools build upon the success of Macro Hive’s Federal Reserve (Fed) sentiment index, providing investors with an enhanced perspective on central bank communications.

Transforming Central Bank Sentiment Analysis

Traditional sentiment indices for central bank statements typically rely on models such as BERT, which are trained using only sentence-level data. Macro Hive’s cutting-edge approach utilises the latest large language models (LLMs) and integrates both paragraph- and sentence-level analysis. This dual-layered technique captures subtle contextual nuances, setting a new benchmark in central bank sentiment analysis.

Bilal Hafeez, Head of Research at Macro Hive, commented:

“Our new LLM sentiment indices provide investors with a significant edge by extracting more precise signals from central bank communication.

“All our indices lead interest rates and outperform existing sentiment indices, and our expansion to the BoE, ECB and BoJ reflects our commitment to delivering tools that push the boundaries of financial analytics.”

A Comprehensive Suite of Indices for Global Investors

By introducing sentiment indices for the ECB, BoE, and BoJ, Macro Hive offers investors deeper insights into the decision-making of some of the world’s most influential central banks. This expansion enables market participants to assess policy shifts and sentiment trends with unparalleled precision across major global economies.

For further information about Macro Hive’s central bank sentiment indices, contact [email protected].