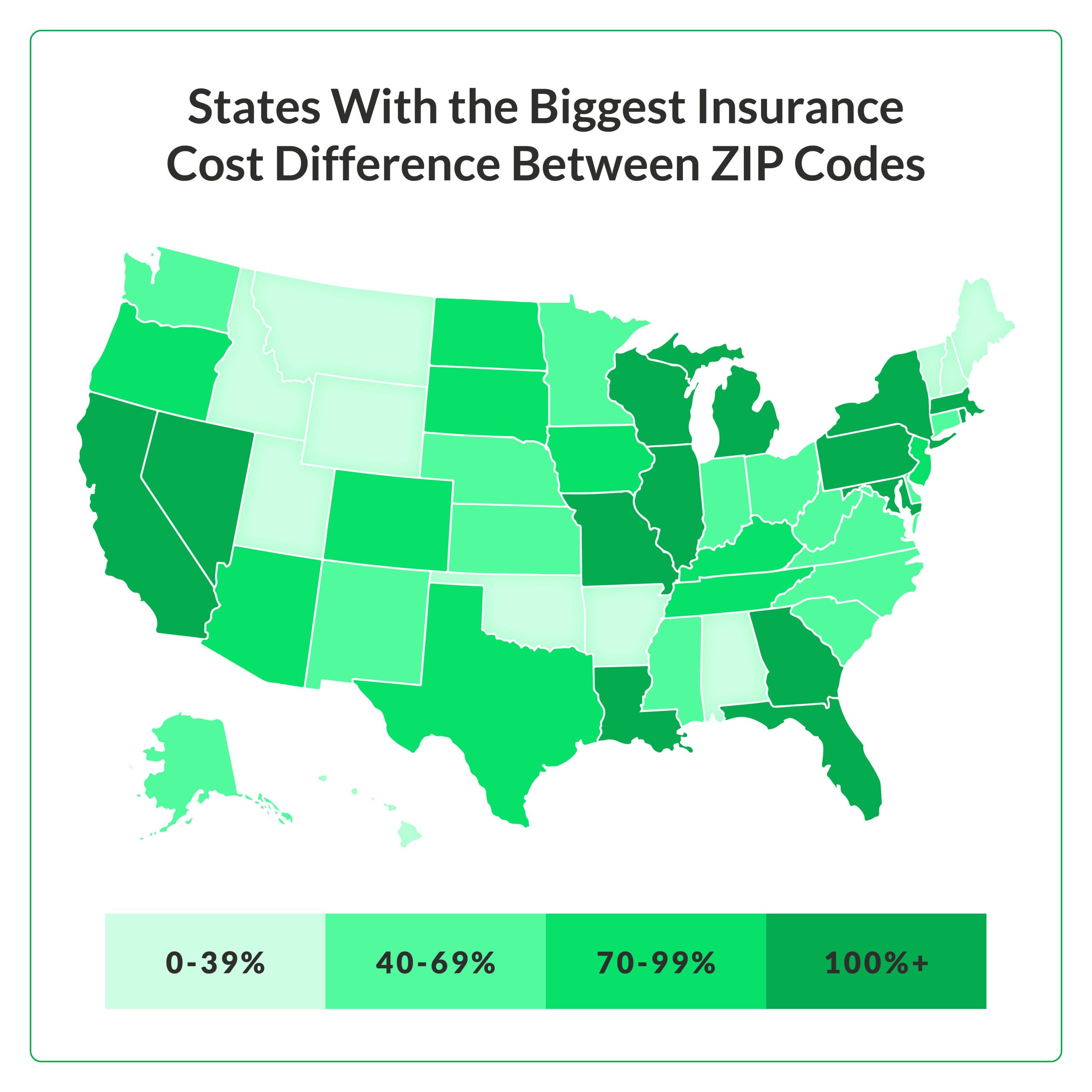

In a recent MarketWatch Guides article, significant discrepancies in car insurance premiums based on location within each state were brought to light. The study indicates that rural areas generally benefit from lower premiums, while urban and suburban areas face higher costs.

Among the states analysed, New York stands out with the most substantial cost difference between ZIP codes, a staggering 240%. Other states ranking in the top ten for notable disparities include Pennsylvania, Michigan, and Wisconsin.

These disparities in premiums can be attributed to various risk factors, such as natural disasters, traffic density, and property crime risks. Typically, these risks tend to escalate closer to urban centers, while rural areas are considered less hazardous.

On a national level, the average disparity hovers around 75%, signifying a two-thirds increase in auto insurance premiums in ZIP codes closer to cities. These disparities have drawn comparisons to modern-day redlining when examining demographic information nationwide.

To tackle higher insurance premiums in urban and suburban ZIP codes, MarketWatch Guides recommends exploring various strategies. One effective approach is to seek out the most affordable car insurance rates by comparing quotes from multiple providers. Additionally, looking for available discounts, bundling policies, improving credit scores, opting for less coverage or a higher deductible, and considering telematics insurance (such as pay-per-mile or safe driving programs) can yield substantial savings on auto insurance premiums.