The UK has just announced comprehensive tax cuts in effort to improve its economy, which has been failing to grow throughout 2023. Jermey Hunt, UK’s Chancellor, said that he is going to turbo-charge the economy, and laid out the foundation of his tax-cuts alongside the 2024 budget.

Here is the gist of Hunt’s plans:

Tax-Related Measures:

- National Insurance cut by 2%.

- Tax cut for self-employed by abolishing class 2 national insurance contributions and cutting class 4 contributions.

- Permanent extension of the business investment tax break known as “full expensing”.

- Freeze on alcohol duty.

Budget-Related Measures:

- Increase in the living wage from £10.42 to £11.44 per hour.

- Benefits to rise with inflation at 6.7%.

- New crackdown on benefits for those not finding work within 18 months.

- State pension to rise at 8.5%.

- £4.5bn fund to boost green technology.

- Measures to ease housing and planning backlog, including allowing houses to be converted into flats.

The Chancellor says that the time is now ripe for such cuts because of how inflation has slowed down in the UK. Inflation in October ‘22 was as high as 8.6% and is now halved at 4.8% for November ‘23.

In response, the Bank of England has warned The Chancellor that inflation may fall more slowly than Hunt expects, but that has not deterred him from moving forward with his proposals.

Reactions from the financial markets are so far positive.

The bond market has been crashing since the announcement, with Glit yields rising to 4.14% mid-day (up from 4.09% at the beginning of the trading day).

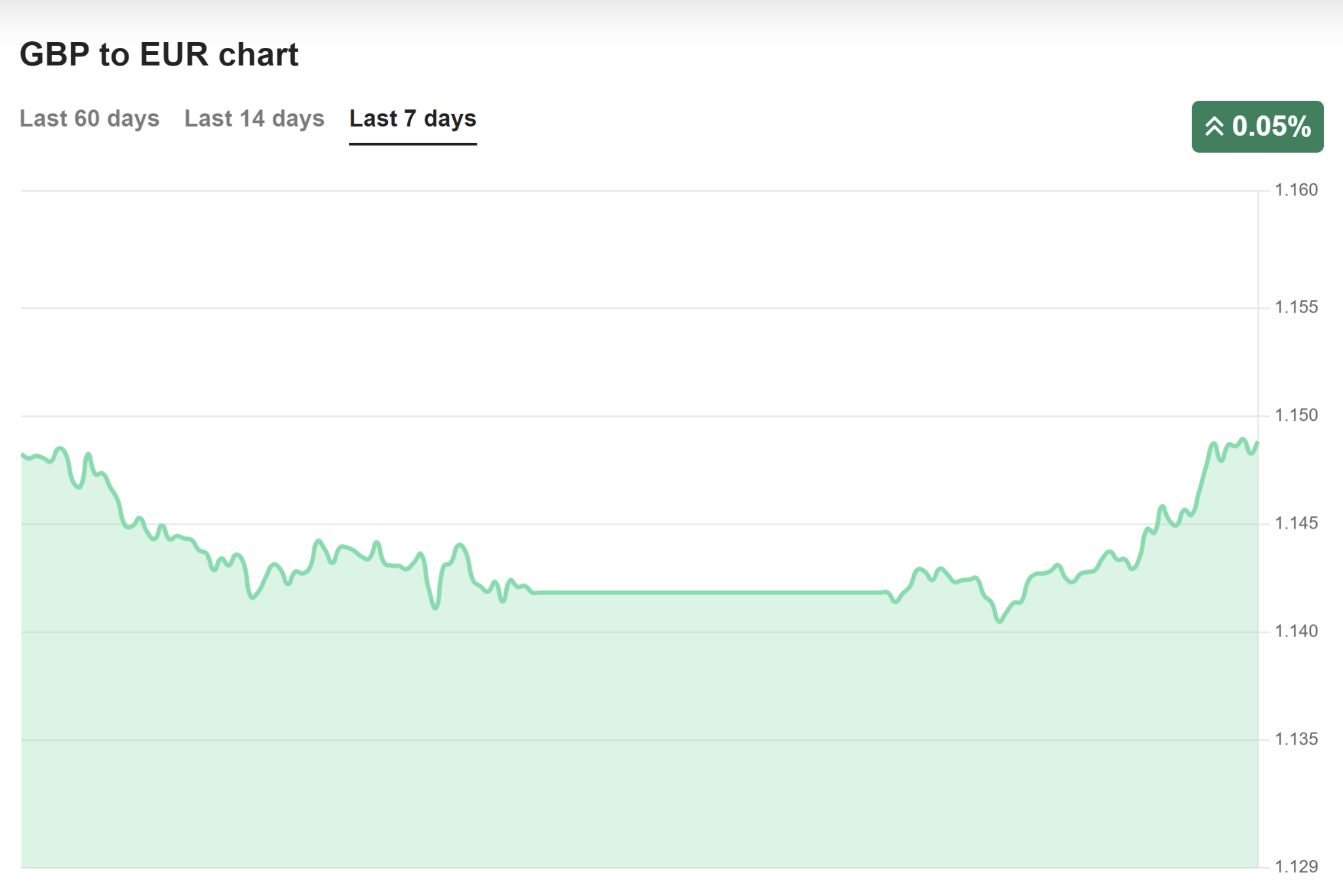

The Pound Sterling’s exchange rate against the Euro has moved up almost 1% as a knee-jerk reaction to the announcement.

Screenshot from TopMoneyCompare

How Tax Cuts and Budget Changes Should Help UK’s Economy?

Facing a unique G7 contraction with a predicted 0.6% shrink in its economy, the UK is contending with post-pandemic aftereffects, Brexit-related challenges, a surge in energy costs, and workforce shortages, alongside global issues like wars on two frontiers now and the Millennial lack of job loyalty.

In this context, Hunt’s proposed tax cuts and budget are a serious attempt to reinvigorate and boost economic growth.

Will this work?

The efficacy of Hunt’s fiscal strategy in a challenging period for global and British economy is up for debate.

While the Institute of Economic Affairs sees the tax cuts as a catalyst for increasing disposable income and investment, suggesting that a stimulative effect on the economy without excessively burdening monetary policy, critics from the National Institute of Economic and Social Research (NIESR) caution against pre-election tax cuts.

They argue that a sustainable boost to the economy would come from increasing public investment in infrastructure and skills, which would be more beneficial in the long term. The NIESR recommends raising public investment to 3% of GDP annually, contrasting with a trend that sees it falling to roughly 2% in coming years, which could be a shortfall of around 30 billion pounds annually.

The OECD echoes this sentiment, pointing out that while the UK’s growth projections have improved slightly, its fiscal space remains limited, cautioning the government against extensive tax cuts without a comprehensive strategy to improve labor availability and investment certainty.

Moreover, with the UK’s public finances already stretched thin, and the economy still adjusting to post-Brexit trade rules, a holistic approach focusing on long-term investment rather than short-term tax cuts may be required to ensure sustainable growth. Time will tell.