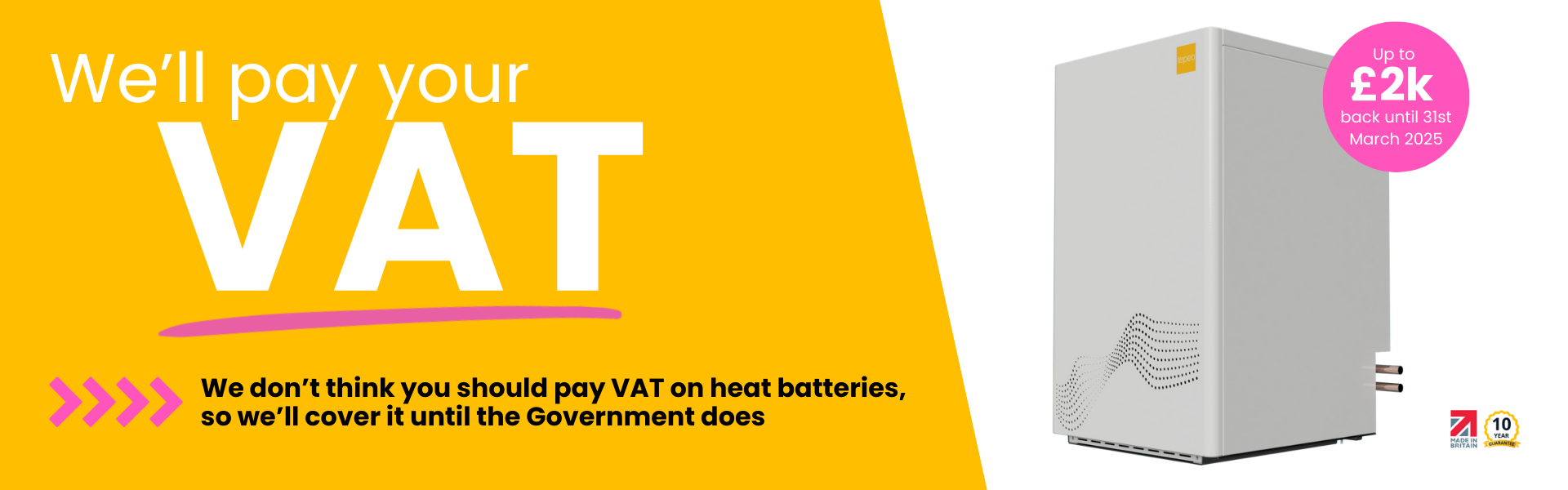

UK-based ClimateTech innovator tepeo is challenging the Government’s exclusion of heat batteries from VAT relief by offering up to £2,000 cashback on its Zero Emission Boiler (ZEB). This bold move underscores tepeo’s commitment to fairer treatment for all renewable heating technologies and highlights the need for policy reform.

tepeo’s cashback initiative follows the Government’s recent Autumn Statement, which retained VAT relief for heat pumps and biomass boilers but excluded other technologies such as heat batteries. This decision has disappointed many within the industry, as heat batteries offer a viable solution for households seeking to transition to low-carbon heating.

In response, tepeo is absorbing the VAT cost for its ZEB product, aiming to showcase the benefits of extending VAT relief to all low-carbon heating technologies. This approach could help lower energy costs for UK households and accelerate progress towards achieving Net Zero targets.

“The Government’s decision leaves homeowners with limited access to affordable low-carbon heating options. At tepeo, we want to show how VAT relief could make a real difference,” said Johan du Plessis, CEO of tepeo. “We’re a young company, and absorbing this VAT cost is a significant decision for us, but it’s crucial that UK households are given the opportunity to switch to greener heating technologies without being penalised.”

The ZEB, a straightforward replacement for traditional fossil fuel boilers, integrates seamlessly with existing heating systems and supports households in cutting carbon emissions. By shifting energy consumption to cheaper, off-peak times, heat batteries like the ZEB also improve energy security and efficiency.

Despite lobbying efforts from industry leaders and MPs, led by Afzal Khan MP, the Government did not include VAT relief for heat batteries in its Autumn Statement. However, heat batteries remain vital for homes unsuitable for heat pumps or facing space constraints.

Afzal Khan MP commented: “Prior to the Autumn Statement, the Government took the decision to enable social housing providers to claim up to £15,000 per property for the installation of alternative low-carbon heating solutions, such as heat batteries. Awarding VAT relief to heat batteries represented the next natural step for the Government, which would have further incentivised the adoption of low carbon home heating.”

Khan continued: “Whilst this isn’t the outcome that I, my colleagues or industry would have hoped for, I will continue to advocate for the increased adoption and roll out of low carbon heating technologies, such as heat batteries, which I hope will be awarded VAT relief at the next fiscal event.”

The Minister for Energy Consumers, Miatta Fahnbulleh, acknowledged the potential of heat batteries for homes with limited space, signalling a gradual shift in Government attitudes. Nonetheless, the financial disparity between heat batteries and heat pumps remains a significant challenge.

Supported by parliamentary leaders, tepeo and the heating industry are calling for a fair tax system that supports all sustainable heating technologies. With recent trials demonstrating the ZEB’s ability to lower bills and balance electricity grids, tepeo’s VAT-backed initiative could catalyse much-needed policy changes.

“We hope our initiative will inspire policymakers to take action,” concluded du Plessis. “If we want to achieve Net Zero, we need a fair and inclusive tax system that supports all green technologies and doesn’t favour the wealthy and those in larger homes. The time to act is now.”